Time series analysis applied to Klabin's quarterly profits

Keywords:

Outliers, structural break, periodic, frequencyAbstract

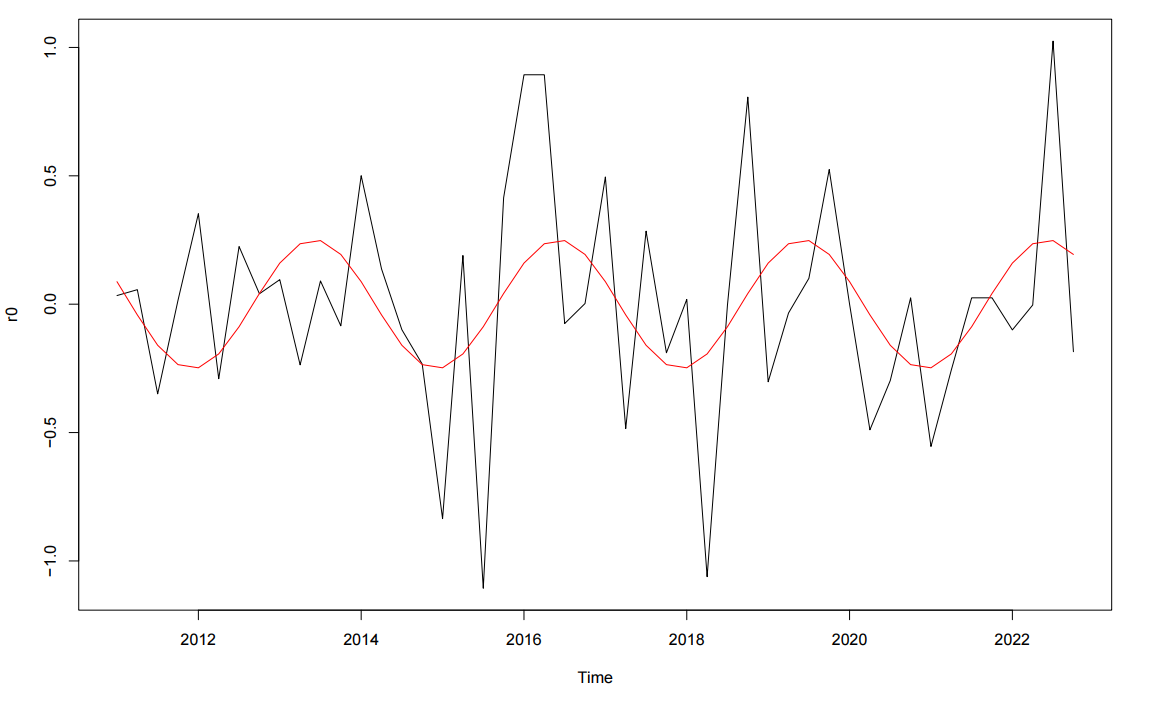

Klabin S.A. is a century-old company, a market leader, and also the largest producer and exporter of packaging paper in the country. The difference between revenues and costs/expenses translates into the company’s net profit, the main point of interest for investors, as the stock market share prices are directly influenced by the company’s profit. In this regard, the goal of this study is to analyze the historical series of Klabin’s quarterly profits, examine their temporal patterns, and fit a model to predict future values. The ARMA(1, 1) model, including two indicator variables and a pair of harmonic components, was used to model the effect of an additive outlier, structural break, and periodicity, respectively. The errors generated by the model can be considered normal and exhibit characteristics of white noise. The model’s forecast for the first two quarters of the year 2023 resulted in an approximately 7% Mean Absolute Percentage Error (MAPE).

References

BAI, J., PERRON, P. Estimating and testing linear models with multiple structural changes. Econometrica, v.66, n.1, p.47-78, 1998.

BOX, G. E. P.; JENKINS, G. M. Time series analysis forecasting and control. San Francisco: Holden-Day, 1970, 537p.

BOX, G. E. P.; TIAO, G. C. A change in level of non stationary time-series. Biometrika, London, v.52, n.1, p.181-192, 1965.

CHANG, I. H.; TIAO, G. C.; CHEN, C. Estimation of time series parameters in the presence of outliers. Technometrics, v.30, n.2, p.193-204, 1988.

EMILIANO, P. C.; VIVANCO, M. J. F.; MENEZES, F. S. Information criteria: How do they behave in different models?. Computational Statistics & Data Analysis, v.69, p.141-153, 2014.

GLASS, G. V. Estimating the effects of intervention into a non-stationary time-series. American Educational Research Journal, v.9, n.3, p.463-477, 1972.

LAFER, C. A Saga das famílias Lafer e Klabin no Brasil e o pioneiro Maurício Klabin. Entrevista a Roberta Sundfeld, 2020.

LJUNG, G. M.; BOX, G. E. On a measure of lack of fit in time series models. Biometrika, v.65, n.2, p.297-303, 1978.

MORETTIN, P. A.; TOLOI, C. M. C. Análise de séries temporais. 2. ed. São Paulo: E. Blücher, 2006. 538p.

PERCIVAL, D.; WALDEN, A. Spectral analysis for physical applications. Cambridge: Cambridge University Press, 1993. 602p.

R CORE TEAM. R: a language and environment for statistical computing. R Foundation for Statistical Computing, Vienna, Austria. 2023.

SCHWARZ, G. Estimating the dimension of a model. Annals of Statistics, v.6, n.2, p.461-464, 1978.

Downloads

Published

Versions

- 11-04-2024 (2)

- 15-03-2024 (1)

How to Cite

Issue

Section

License

Proposta de Política para Periódicos de Acesso Livre

Autores que publicam nesta revista concordam com os seguintes termos:

- Autores mantém os direitos autorais e concedem à revista o direito de primeira publicação, com o trabalho simultaneamente licenciado sob a Licença Creative Commons Attribution que permite o compartilhamento do trabalho com reconhecimento da autoria e publicação inicial nesta revista.

- Autores têm autorização para assumir contratos adicionais separadamente, para distribuição não-exclusiva da versão do trabalho publicada nesta revista (ex.: publicar em repositório institucional ou como capítulo de livro), com reconhecimento de autoria e publicação inicial nesta revista.

- Autores têm permissão e são estimulados a publicar e distribuir seu trabalho online (ex.: em repositórios institucionais ou na sua página pessoal) a qualquer ponto antes ou durante o processo editorial, já que isso pode gerar alterações produtivas, bem como aumentar o impacto e a citação do trabalho publicado (Veja O Efeito do Acesso Livre).