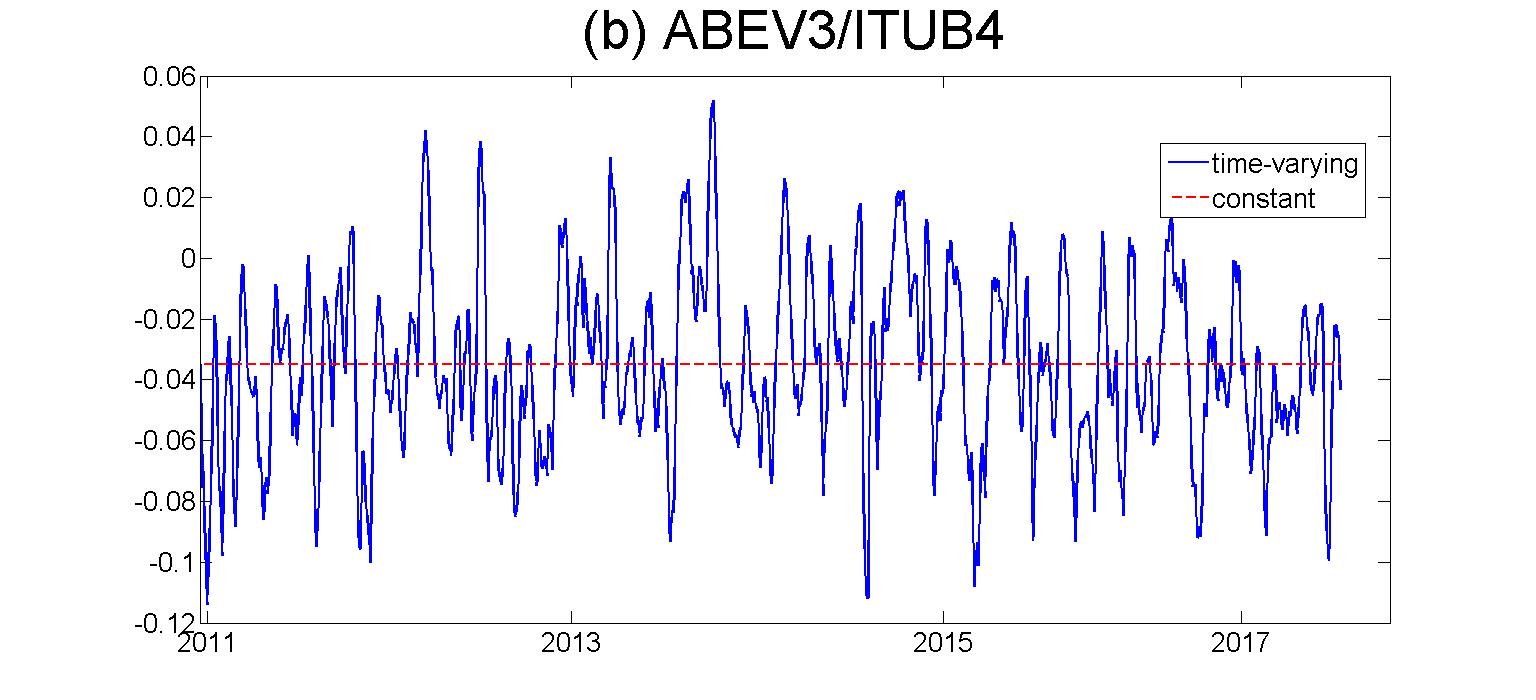

Correlation between BM&FBOVESPA stock returns: an analysis via dynamic copula

Keywords:

Copulas, stock returns, correlationAbstract

References

DING, Z.; GRANGER, C. W. J.; ENGLE, R. F. A long memory property of stock market returns and a new model. Journal of Empirical Finance, v. 1, n. 1, p. 83-106, 1993.

ENGLE, R. F. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica, v. 50, n. 4, p. 987-1007, 1982.

GHALANOS, A. rugarch: Univariate GARCH models. R package version 1.3-8. 2017.

JOE, H., & XU, J. J. The estimation method of inference functions for margins for multivariate models. Technical Report no. 166. Department of Statistics, University of British Columbia, Vancouver, 1996.

LACERDA, A. C. D. Dinâmica e evolução da crise: discutindo alternativas. Estudos Avançados, v.31, n.89, p. 37-49, 2017.

MARKOWITZ, H. Portfolio selection. The Journal of Finance, v. 7, n. 1, p. 77-91, 1952.

PATTON, A. J. Modelling asymmetric exchange rate dependence. International Economic Review, v. 47, n. 2, 2006.

SKLAR, A. Fonctions de répartition et leurs marges. Publications de la Institut de Statistique de la Université de Paris, 8, 229-231. 1959.

R CORE TEAM. R: A language and environment for statistical computing. R Foundation for Statistical Computing, Vienna, Austria. 2019. ISBN 3-900051-07-0, URL http://www.R-project.org/.

Downloads

Published

How to Cite

Issue

Section

License

Proposta de Política para Periódicos de Acesso Livre

Autores que publicam nesta revista concordam com os seguintes termos:

- Autores mantém os direitos autorais e concedem à revista o direito de primeira publicação, com o trabalho simultaneamente licenciado sob a Licença Creative Commons Attribution que permite o compartilhamento do trabalho com reconhecimento da autoria e publicação inicial nesta revista.

- Autores têm autorização para assumir contratos adicionais separadamente, para distribuição não-exclusiva da versão do trabalho publicada nesta revista (ex.: publicar em repositório institucional ou como capítulo de livro), com reconhecimento de autoria e publicação inicial nesta revista.

- Autores têm permissão e são estimulados a publicar e distribuir seu trabalho online (ex.: em repositórios institucionais ou na sua página pessoal) a qualquer ponto antes ou durante o processo editorial, já que isso pode gerar alterações produtivas, bem como aumentar o impacto e a citação do trabalho publicado (Veja O Efeito do Acesso Livre).