Modeling the conditional volatility of arabica coffee prices

Keywords:

heteroscedasticity, conditional variance, forecastAbstract

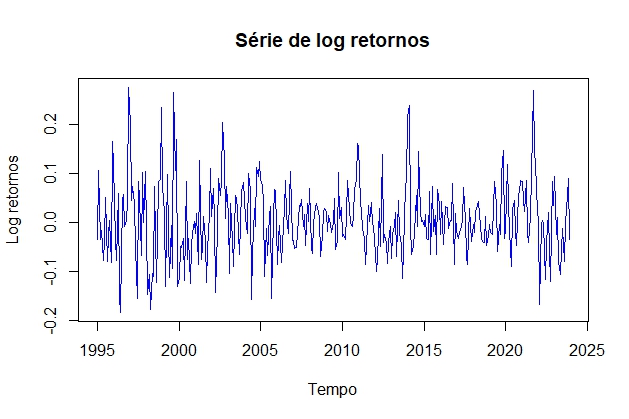

Arabica coffee (Coffea arabica) accounts for more than 60% of the world’s coffee production. It is valued for its aromatic complexity and sweet flavor. This work aims to model the volatility of Arabica coffee prices and fit a model to estimate their variations. The data covers monthly prices per 60 kg bag from January 1995 to December 2023. Initially, the price series was transformed into the series of logarithmic returns. The AR(1) model with a cosine component was used to model the existing periodicity and residual autocorrelation. However, the Box-Pierce test, applied to the series of squared residuals, still indicated heteroscedasticity. Therefore, a GARCH(1,1) model with a Skew t-Student distribution for the residuals was fitted. This model was chosen due to the lowest AIC (Akaike Information Criterion) value. It was also found that the residuals of the GARCH(1,1) model can be considered white noise. The interval projection for conditional volatility indicated that coffee prices over the next six months could fall by up to 12% or rise by up to 14%, approximately.

References

ACHIM, Z; HOTHORN, T.; Diagnostic Checking in Regression Relationships. R News 2(3), 7-10. 2002. Disponível em: https://CRAN.R project.org/doc/Rnews/.

AKAIKE, H.; A new look at the statistical model identification. IEEE transactions on automatic control, v. 19, n. 6, p. 716-723, 1974.

AZZALINI, A.; The skew-normal distribution and related multivariate families. Scandinavian journal of statistics, v. 32, n. 2, p. 159-188, 2005.

AZZALINI, A.; VALLE, A. D.; The multivariate skew-normal distribution. Biometrika, v. 83, n. 4, p. 715-726, 1996.

AZZALINI, A.; CAPITANIO, A.; Distributions generated by perturbation of symmetry with emphasis on a multivariate skew t-distribution. Journal of the Royal Statistical Society Series B: Statistical Methodology, v. 65, n. 2, p. 367-389, 2003.

BAILLIE, R. T.; BOLLERSLEV, T. The message in daily exchange rates: a conditional-variance tale. Journal of Business and Economic Statistics, v. 7, n. 3, p. 297-305, 1986.

BARBOSA, E. C.; SÁFADI, T.; SILVA, C. H. O.; MANUELI, R. C. (2014). Box & Jenkins methodology: an application in raw milk data from the state of Minas Gerais. Inst. Laticínios Cândido Tostes, Juiz de Fora, v. 69, n. 2, p. 129-139. 2014

BOLLERSLEV, T. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics. n. 31, p. 307-327, 1986.

BOLLERSLEV T. A conditionally heteroskedastic time series model for speculative prices and rates of return. Review of Economics and Statistics, v. 69, p. 542–547. 1987.

BOLLERSLEV, T.; ENGLE, R. F.; NELSON, D. B. Modelos ARCH. Manual de econometria, v. 4, p. 2959-3038, 1994.

BROOKS, C.; BURKE, S. P. Information criteria for GARCH model selection. The European journal of finance, v. 9, n. 6, p. 557-580, 2003.

CASELLA, G.; BERGER, R. L. Statistical lnference. Duxbury press, 2002.

CAEIRO, F.; MATHEUS, A.; randtests: Testing Randomness in R. R package version 1.0.2, disponível em: https://CRAN.R project.org/package=randtests.

CONAB. Análise Mensal: Café. Maio, 2019. Brasília: Conab, 2019a

COSTA, C. H. G.; ANDRADE, F. T.; de CASTRO JÚNIOR, L. G. ANÁLISE DA VIABILIDADE ECONÔMICO-FINANCEIRA DA CAFEICULTURA: UM ESTUDO NAS PRINCIPAIS REGIÕES PRODUTORAS DE CAFÉ DO BRASIL. ABCustos, [S. l.], v. 7, n. 1, p. 30–52, 2012. DOI: 10.47179/abcustos.v7i1.141. Disponível em: https://revista.abcustos.org.br/abcustos/article/view/141. Acesso em: 19 jun. 2024.

COOXUPÉ. 2024. Disponível em: https://www.cooxupe.com.br/noticias/cooxupe-em-minas-gerais-e-modelo-de-cooperativismo-no-mundo/. Acesso em: 06 jun. 2024.

COX, D. R.; STUART, A. Some quick sign tests for trend in location and dispersion. Biometrika, v. 42, n. 1/2, p. 80-95, 1955.

FERREIRA, L. T.; CAVATON, F. T. Safra dos Cafés do Brasil foi estimada em 58,08 milhões de sacas para este ano de 2024. Embrapa, 2024. Disponível em: https://www.embrapa.br/busca-de-noticias/-/noticia/86520314/artigo—safra-dos-cafes-do-brasil-foi-

estimada-em-5808-milhoes-de-sacas-para-este-ano-de-2024. Acesso em: 10 abr. 2024.

GAUSS, C. F.; Bestimmung der genauigkeit der beobachtungen. Zeitschrift Astronomi 1816, 1: 185–197.

GODOI, L. G. A. Distribuição t-assimétrica univariada: propriedades e inferência. 2007. Tese de doutorado. Universidade de São Paulo.

JENKINS, G. M.; WATTS, D. G. Spectral Analysis and Its Applications, Holden-Day, San Francisco, 1968.

KATZ, R. W.; PARLANGE, M. B.; NAVEAU, P. Statistics of extremes in hydrology. Advances in water resources, v. 25, n. 8-12, p. 1287-1304, 2002.

MCLEOD, A. I.; Test short time series for periodicity based on periodograms. 2016. Disponível em: https://rdocumentation.org/packages/ptest/versions/1.0-8.

MORETTIN, P. A.; TOLOI, C. M. C. Análise de séries temporais. 2. ed. São Paulo: E.Blücher, 538 p. 2006.

NAGAY, J. H. C. Café no Brasil: dois séculos de história. UNICAMP, Formação Econômica, Campinas,(3), p. 17-23, 1999.

LAMOUNIER, W. M. Análise da volatilidade dos preços no mercado spot de cafés do Brasil. Organizações Rurais e Agroindustriais/Rural and Agro-Industrial Organizations, v. 8, n. 2, p. 160-175, 2006.

LJUNG, G. M.; BOX, G. E. On a measure of lack of fit in time series models. Biometrika, 174 v. 65, n. 2, p. 297-303, 1978.

ICO. a HISTÓRIA DO CAFÉ. Disponível em: https://www.ico.org/pt/coffee_storyp.asp. Acesso em: 12 mar. 2024. Parra, F.; descomponer: Seasonal Adjustment by Frequency Analysis. R package version 1.6. 2021. Disponível em: https://CRAN.R-project.org/package=descomponer.

SAKIYAMA, N. S. O café arábica. In: SAKIYAMA, N. S.; MARTINEZ, H. E. P.; TOMAZ,M. A.; BORÉM, A. Café arábica: do plantio à colheita. Viçosa: UFV, 2015. p. 316.

TRAPLETTI, A.; HORNIK, K.; tseries: Time Series Analysis and Computational Finance R package version 0.10-56. 2024. Disponívl em: https://CRAN.R-project.org/package=tseries.

WUERTZ, D.; CHALABI, Y.; SETZ, T.; MAECHLER. M.; BOSHNAKOV, G. N.; fGarch: Rmetrics - Autoregressive Conditional Heteroskedastic Modelling. R package version 4033.92, 2024.

Disponível em: https://CRAN.R project.org/package=fGarch.

Downloads

Published

How to Cite

Issue

Section

License

Proposta de Política para Periódicos de Acesso Livre

Autores que publicam nesta revista concordam com os seguintes termos:

- Autores mantém os direitos autorais e concedem à revista o direito de primeira publicação, com o trabalho simultaneamente licenciado sob a Licença Creative Commons Attribution que permite o compartilhamento do trabalho com reconhecimento da autoria e publicação inicial nesta revista.

- Autores têm autorização para assumir contratos adicionais separadamente, para distribuição não-exclusiva da versão do trabalho publicada nesta revista (ex.: publicar em repositório institucional ou como capítulo de livro), com reconhecimento de autoria e publicação inicial nesta revista.

- Autores têm permissão e são estimulados a publicar e distribuir seu trabalho online (ex.: em repositórios institucionais ou na sua página pessoal) a qualquer ponto antes ou durante o processo editorial, já que isso pode gerar alterações produtivas, bem como aumentar o impacto e a citação do trabalho publicado (Veja O Efeito do Acesso Livre).