Time series analysis: a study of the stock exchange investment portfolio of the companies Petrobras, Banco do Brasil, Vale and Ambev.

Keywords:

GARCH Model, EGARCH Model, Financial Market, Risk Management, Conditional VolatilityAbstract

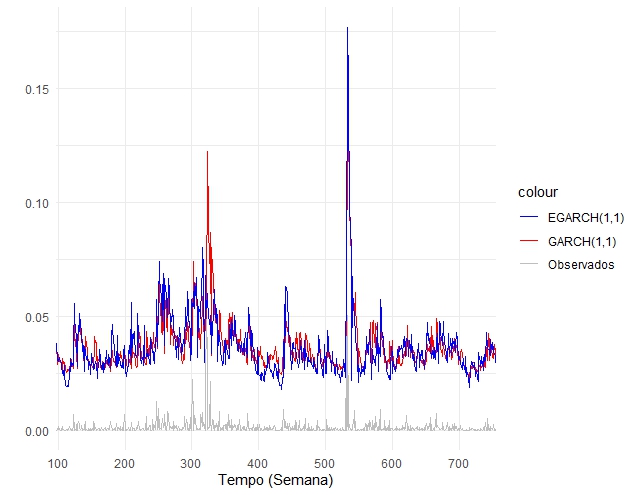

The global financial landscape, marked by significant volatility in recent years, especially during economic, geopolitical, and health events, underscores the urgency of robust risk management strategies. Market volatility, as highlighted by the COVID-19 pandemic, reinforces the importance of financial time series analysis. These theories offer a temporal view of data, enabling the identification of trends and patterns in markets. This study employs the GARCH(1,1) and EGARCH(1,1) models to analyze the return series of an investment portfolio, highlighting their significant performance in understanding conditional volatility. The GARCH(1,1) model yields robust results, indicating a gradual increase in conditional volatility, guiding cautious risk mitigation strategies. Conversely, the EGARCH(1,1) model predicts a slight decrease in volatility, allowing for assertive strategies in a less variable environment. These projections provide essential insight(s) for portfolio management, emphasizing the importance of informed decision-making and adaptive strategies in the dynamic landscape of investments.

References

ALVES, J. S. Análise comparativa e teste empírico da validade dos modelos CAPM tradicional e condicional: o caso das ações da Petrobrás. Revista Ciência Admin., vol. 13, p. 1-11. 2007.

ASSIS, C. A.; CARRANO E. G.; PEREIRA, A C. M. Predição de tendências em séries financeiras utilizando metaclassificadores. Economia Aplicada, vol. 24, p. 1-76, 2020.

BOLLERSLEV, T. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, vol. 31, p. 307-327, 1986.

BOX, G. P.; JENKINS, G. M. Time series analysis, forecasting and control. San Francisco: Holden-Day, p. 362-366, 1976.

DA SILVA, C. A. G. Modelagem de estimação da volatilidade do retorno das ações brasileiras: os casos da Petrobrás e Vale. Cadernos do IME, vol. 26, p. 1-14, 2009.

DICKEY, D. A.; FULLER, W. A. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, vol. 74, p. 427-431, 1979.

ENGLE, R. F. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica, vol. 50, p. 987–1007, 1982.

LJUNG, G. M.; BOX, G. E. P. On a Measure of Lack of Fit in Time Series Models. Biometrika, vol. 65, p. 297-303, 1978.

MARKOWITZ, H. Portfolio Selection. Journal of Finance, vol. 7, p.77-91, 1952.

MORETTIN, P. A; TOLOI, C. M. C. Análise de Séries Temporais. São Paulo: Edgar Blucher, p. 61-84, 2020.

NELSON, D. B. Conditional heteroskedasticity in asset returns: A new approach..Econometrica, vol.59, p. 347–370, 1991.

NOGUEIRA, E. C. J.; KOBUNDA, C. N. Análise da Volatilidade do Ibovespa entre 2001 E 2016: Uma estimação através de modelos ARCH. Revista de Economia, vol. 40, p. 1-17, 2019.

PHILLIPS, P. C. B.; PERRON, P. Testing for a unit root in time series regression.Biometrika, vol. 75, p. 335-346, 1988.

QUANTMOD. Disponível em : https://cran.r-project.org/web/packages/quantmod/quantmod.pdf. Acesso em: 08 out. 2023.

R. Disponível em : https://www.r-project.org/. Acesso em: 08 out. 2023.

THOMAZ, P. S.; MATTOS, V. L. D.; Nakamura, L. R.; Konrath, A. C.; NUNES, G. S. Modelos GARCH em ações financeiras: um estudo de caso. Exacta, vol. 18, p. 1-23, 2020.

TSAY, R. S. Analysis of financial time series. John wiley & sons, p. 110-147, 2005.

ZHANG, D.; HU, M.; JI, Q. Financial markets under the global pandemic of COVID-19. Finance Research Letters, vol. 36, p. 2-6, 2020.

Downloads

Published

How to Cite

Issue

Section

License

Proposta de Política para Periódicos de Acesso Livre

Autores que publicam nesta revista concordam com os seguintes termos:

- Autores mantém os direitos autorais e concedem à revista o direito de primeira publicação, com o trabalho simultaneamente licenciado sob a Licença Creative Commons Attribution que permite o compartilhamento do trabalho com reconhecimento da autoria e publicação inicial nesta revista.

- Autores têm autorização para assumir contratos adicionais separadamente, para distribuição não-exclusiva da versão do trabalho publicada nesta revista (ex.: publicar em repositório institucional ou como capítulo de livro), com reconhecimento de autoria e publicação inicial nesta revista.

- Autores têm permissão e são estimulados a publicar e distribuir seu trabalho online (ex.: em repositórios institucionais ou na sua página pessoal) a qualquer ponto antes ou durante o processo editorial, já que isso pode gerar alterações produtivas, bem como aumentar o impacto e a citação do trabalho publicado (Veja O Efeito do Acesso Livre).